Associate (Venture Capital) SOPs

템플릿 설명

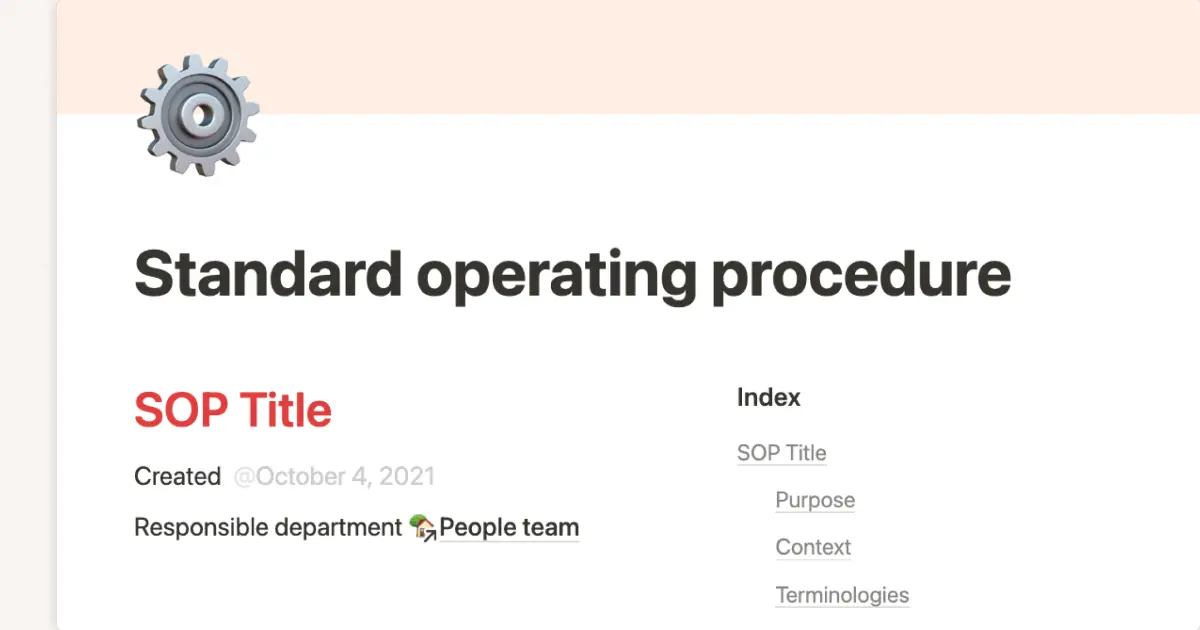

This template contains Standard Operating Procedures (SOPs) for an Associate in a Venture Capital firm, outlining detailed steps for various aspects of the investment process. It covers ten key areas, starting with sourcing and evaluating investment opportunities. This initial SOP emphasizes developing a sourcing strategy, leveraging networks, and conducting initial screenings to identify promising startups. It further details conducting founder calls and presenting opportunities to the investment team.

The document then progresses to market research and competitive analysis, emphasizing defining research objectives, assessing market size and growth, and identifying industry trends and risks. This section also includes a competitive landscape analysis, customer behavior understanding, and regulatory considerations. Following this, the document outlines the due diligence process, covering business model validation, financial due diligence, legal compliance review, and team assessment. It also includes technology, product, customer, and market risk analysis.

Furthermore, the SOPs detail financial modeling and valuation, including gathering data, building financial models, and applying valuation methods like comparable company analysis and discounted cash flow. Key financial metrics for decision-making are also highlighted. The document then focuses on preparing investment memos, providing a structured approach for communicating insights, risks, and recommendations. It includes sections like executive summary, business overview, market opportunity, and financial projections.

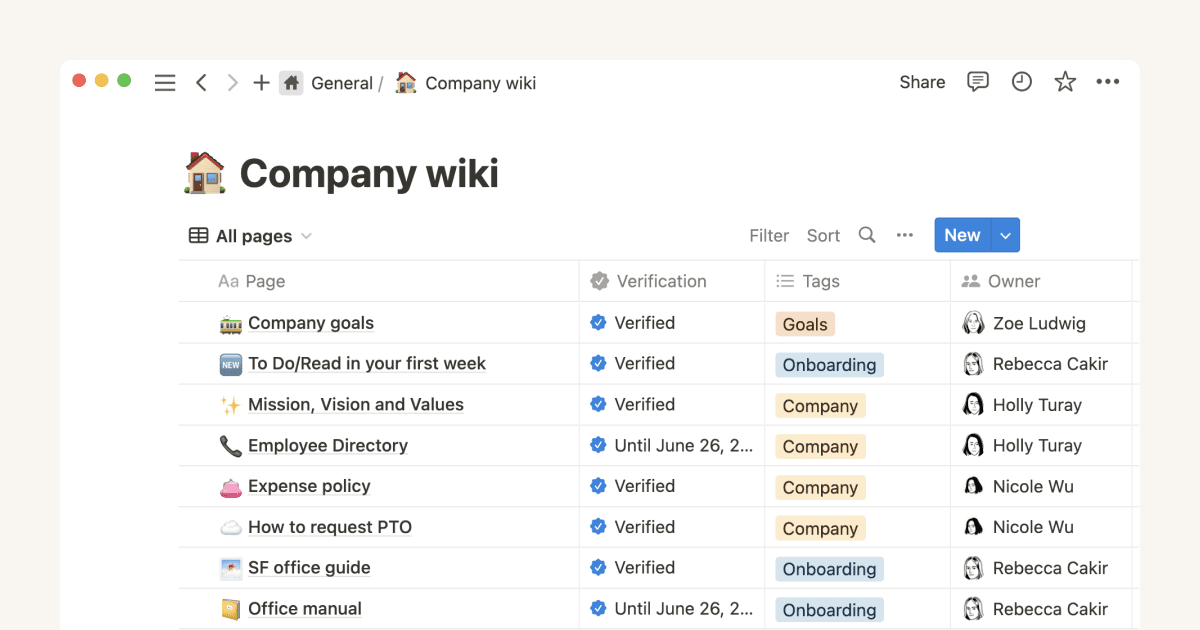

The SOPs also cover managing deal flow and CRM systems, ensuring efficient tracking of investment opportunities and founder interactions. It emphasizes maintaining database integrity and generating reports and analytics. Additionally, the document addresses portfolio company monitoring and reporting, including setting up a monitoring framework, collecting data, and reporting to limited partners. The SOPs conclude with supporting portfolio companies with value-add services, preparing for follow-on investments, and managing exit strategies, ensuring comprehensive guidance for Venture Capital Associates.