Payroll Examiner SOPs

About this template

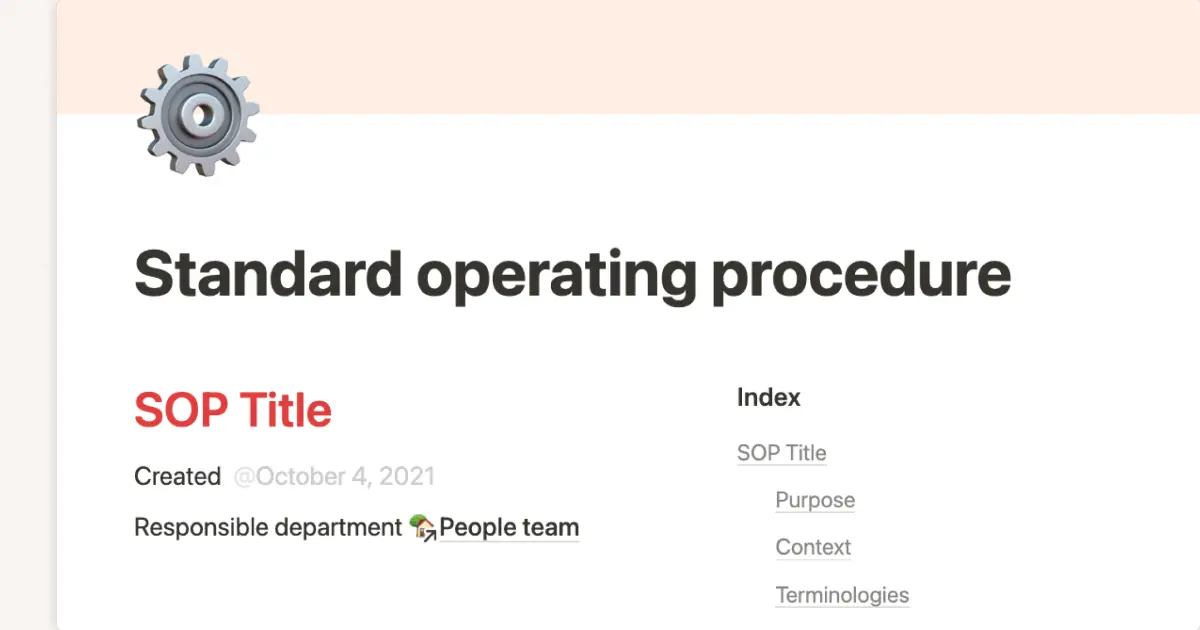

This template contains a series of Standard Operating Procedures (SOPs) for a Payroll Examiner. SOP 1 outlines the process for verifying employee payroll data, emphasizing the importance of accuracy and completeness. SOP 2 details the steps for processing payroll adjustments, including corrections, retroactive pay, bonuses, and deductions. SOP 3 focuses on auditing payroll records to ensure compliance and identify discrepancies.

SOP 4 provides guidance on handling employee payroll queries, aiming for prompt and accurate resolution. SOP 5 covers preparing payroll for processing, including data validation and final reviews. SOP 6 is dedicated to managing payroll compliance checks, ensuring adherence to labor laws and tax regulations. SOP 7 addresses the management of payroll discrepancies, detailing the steps to identify, investigate, and resolve issues.

SOP 8 explains the process of reconciling payroll accounts, ensuring all financial records are accurate and aligned. SOP 9 outlines year-end payroll activities, such as tax reporting, compliance reviews, and distributing annual employee forms. Lastly, SOP 10 focuses on handling payroll system updates and maintenance, ensuring the system remains accurate, secure, and up-to-date.

Each SOP includes sections on purpose, scope, reference SOPs, and step-by-step instructions. The steps are detailed and provide clear guidance on how to perform each task, including accessing the payroll system, retrieving data, verifying information, documenting changes, and communicating with employees. The procedures also emphasize the importance of compliance, accuracy, and confidentiality in handling payroll information.

Collectively, these SOPs provide a comprehensive framework for managing payroll operations effectively. They ensure that payroll examiners can perform their duties accurately and consistently, maintain compliance with regulations, and address any issues that may arise. The document serves as a valuable resource for training new staff and ensuring consistent processes within the payroll department.