More by Template Road

More like this

Related content

For Teams

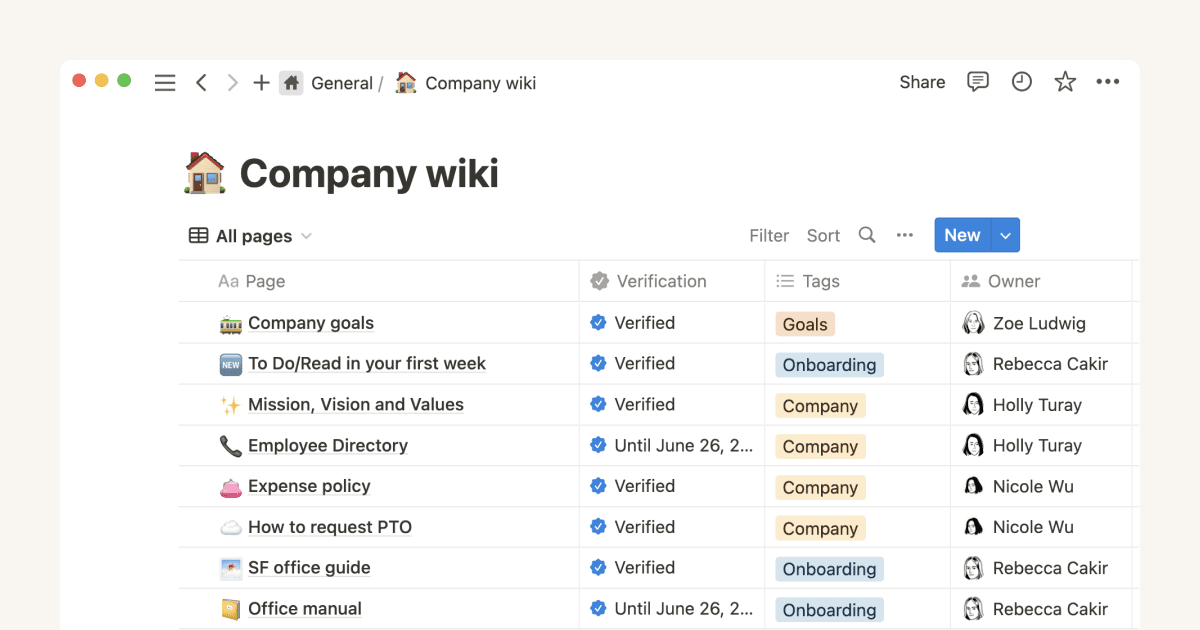

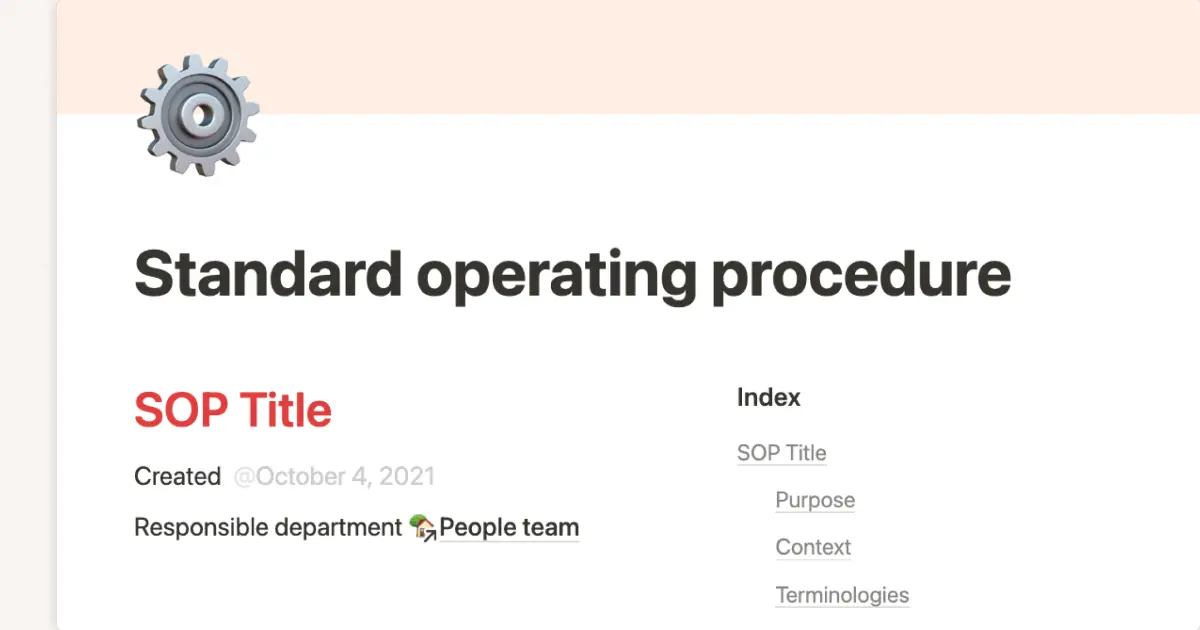

The SOP template your startup needs

Standard operating procedures (SOPs) don’t have to be painful to maintain or systematize. Having an SOP template in place will set your startup up for success. With an SOP template to start with, standard guidelines, and rigorous taxonomy, SOPs can become the resource they’re intended to be instead of a pain.

Nate Martins

Marketing