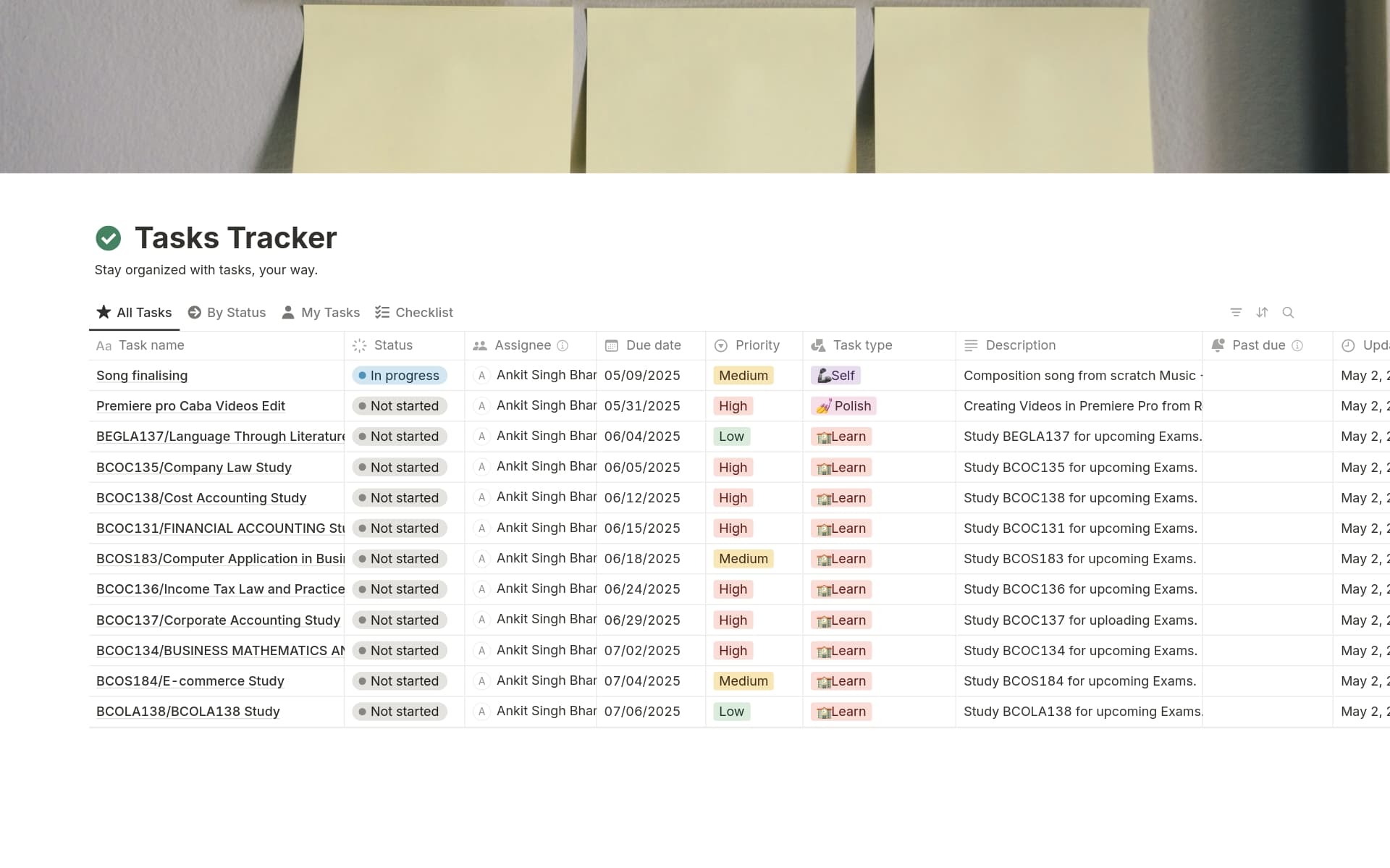

Maintaining a Trading Journal is crucial for any trader's success, as it allows for meticulous tracking of trades, strategies, and outcomes, fostering a disciplined approach to market analysis and decision-making. A well-structured Trading Journal template in Notion can streamline this process, ensuring that all relevant details are captured efficiently and consistently, enabling traders to review and refine their trading strategies effectively.

Before you dive into creating your own Trading Journal, take a look at these Notion templates designed to make the process more straightforward and help you maintain a comprehensive record of your trading activities.

What Should Trading Journal Templates Include?

Choosing the right Trading Journal Template in Notion can significantly enhance your trading analysis and strategy refinement. Here are key components to look for:

Trade Details: This should include the date, instrument, entry and exit points, and trade size. Capturing these details is essential for tracking performance and identifying patterns.

Profit/Loss Tracking: An effective template must automatically calculate profits or losses after each trade, helping you stay informed about your financial status.

Notes Section: Space for notes on each trade can be invaluable for recording market conditions, personal mood, and reasons behind trading decisions.

Review Mechanism: A section for periodic review of trading strategies and outcomes helps in refining approaches and planning future trades.

With these components, a Trading Journal Template not only organizes your trades but also turns data into actionable insights, fostering continuous improvement in your trading journey.

What Should Trading Journal Templates Avoid?

When selecting a trading journal template in Notion, it's important to be aware of certain features that might complicate or hinder your trading analysis. Here are three key components to steer clear of:

Overly Complex Layouts: Templates with too many sections or intricate designs can make data entry cumbersome and distract from the main analysis.

Non-Customizable Fields: Avoid templates that don't allow you to modify fields. Each trader's needs are unique, and flexibility is essential for tailoring your journal to your specific strategies.

Lack of Summary Views: Templates should include summary sections to quickly view profits, losses, and other key metrics. Avoid those without these overview capabilities.

Choosing the right template involves avoiding these pitfalls to ensure that your trading journal is both functional and tailored to your specific trading approach.