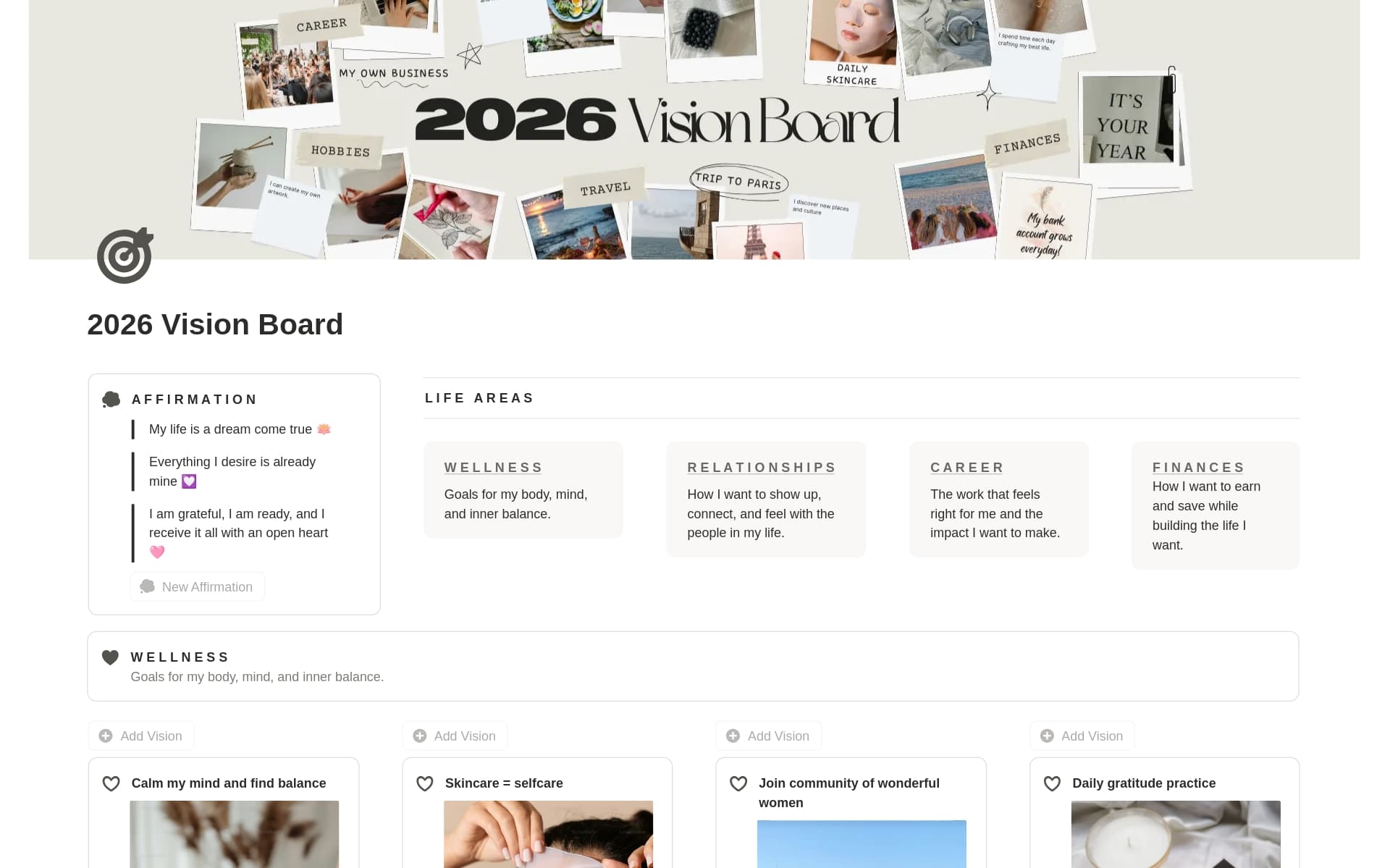

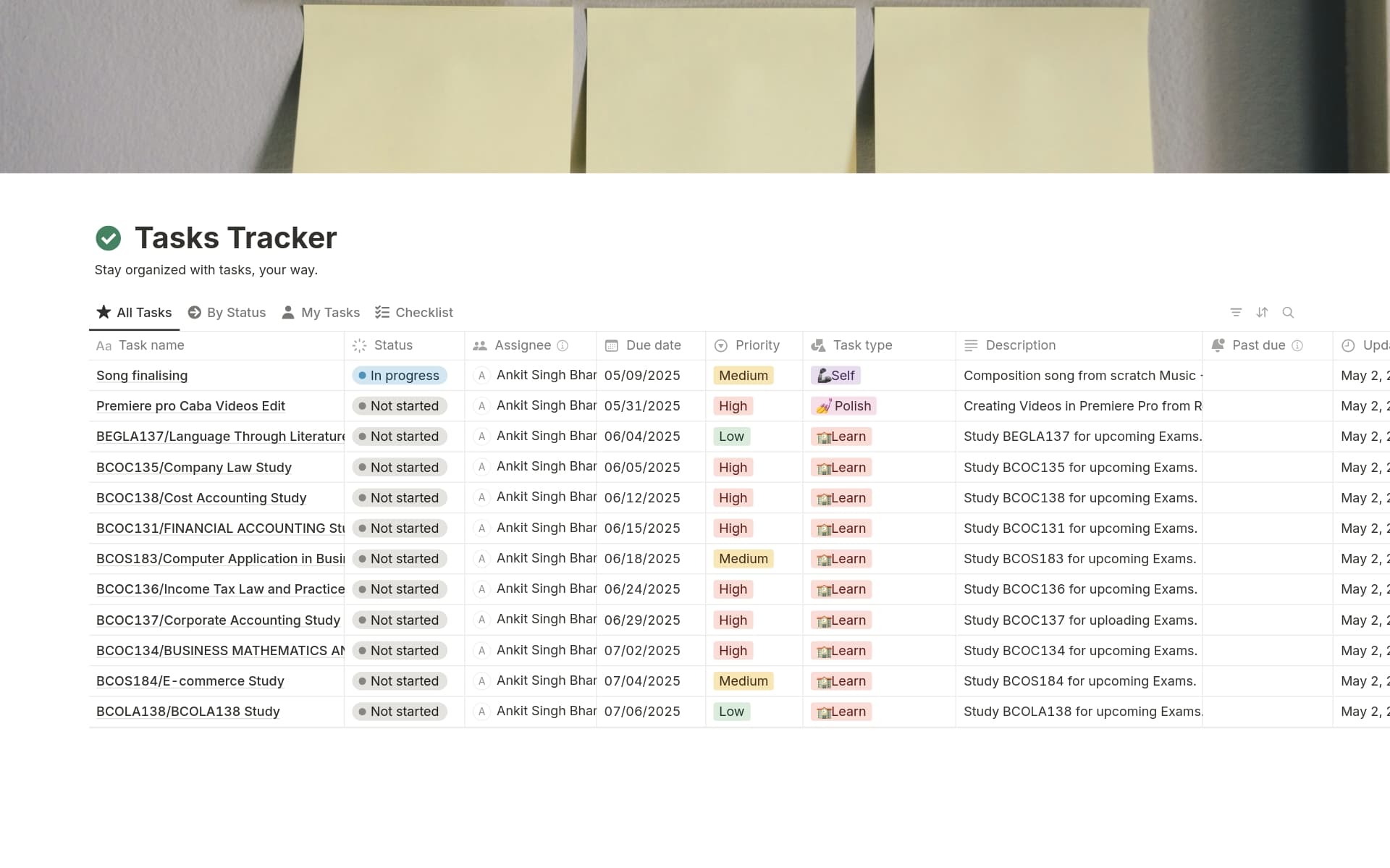

Streamline your venture capital process with customizable Notion templates. Keep track of deals, investors, and portfolios all in one place, and learn how Notion organization can help you make more informed decisions faster.

What Should Venture Capital Templates Include?

Choosing the right Venture Capital template in Notion can streamline your investment management and analysis. Here are key components to look for:

Deal Flow Management: This component should offer a structured way to track and manage potential investment opportunities, ensuring nothing slips through the cracks.

Investor Relations: Look for templates that facilitate communication and updates with investors, including report generation and distribution capabilities.

Portfolio Performance Tracking: Essential for monitoring the health and growth of investments, this feature should provide clear metrics and benchmarks.

Financial Modeling Tools: A good template will include sophisticated tools for financial projections and scenario analysis to aid in decision-making.

Selecting a template with these components will help you maintain a clear overview of your venture capital activities and make informed decisions.

What Should Venture Capital Templates Avoid?

When selecting a Venture Capital template in Notion, it's essential to be aware of certain features that might hinder rather than help. Here are three key components to steer clear of:

Overly Complex Financial Models: Templates with complicated financial projections can be daunting and unnecessary for initial evaluations. Opt for simplicity that allows quick assessments and updates.

Non-Customizable Elements: Avoid templates that don't allow you to tweak or add new sections as your investment strategy evolves. Flexibility is key in adapting to the dynamic nature of venture capital.

Generic Market Analysis Tools: Ensure the template includes or allows integration with up-to-date and detailed market analysis tools. Generic or outdated tools can lead to poor investment decisions.

Choosing the right template involves avoiding features that complicate rather than simplify the investment process. Look for templates that are flexible, straightforward, and equipped with the right tools for precise analysis.