Managing debt effectively is crucial for financial stability and peace of mind. It helps you avoid excessive interest payments, maintain a good credit score, and work towards your financial goals. A Debt Management template in Notion can streamline the process by organizing all your debts, tracking payments, and helping you strategize the payoff plan.

Before you dive into creating your own Debt Management system, take a look at these Notion templates designed to make managing your debt simpler and more efficient.

What Should Debt Management Templates Include?

Choosing the right Debt Management Template in Notion can streamline your financial tracking and debt reduction strategy. Here are key components to look for:

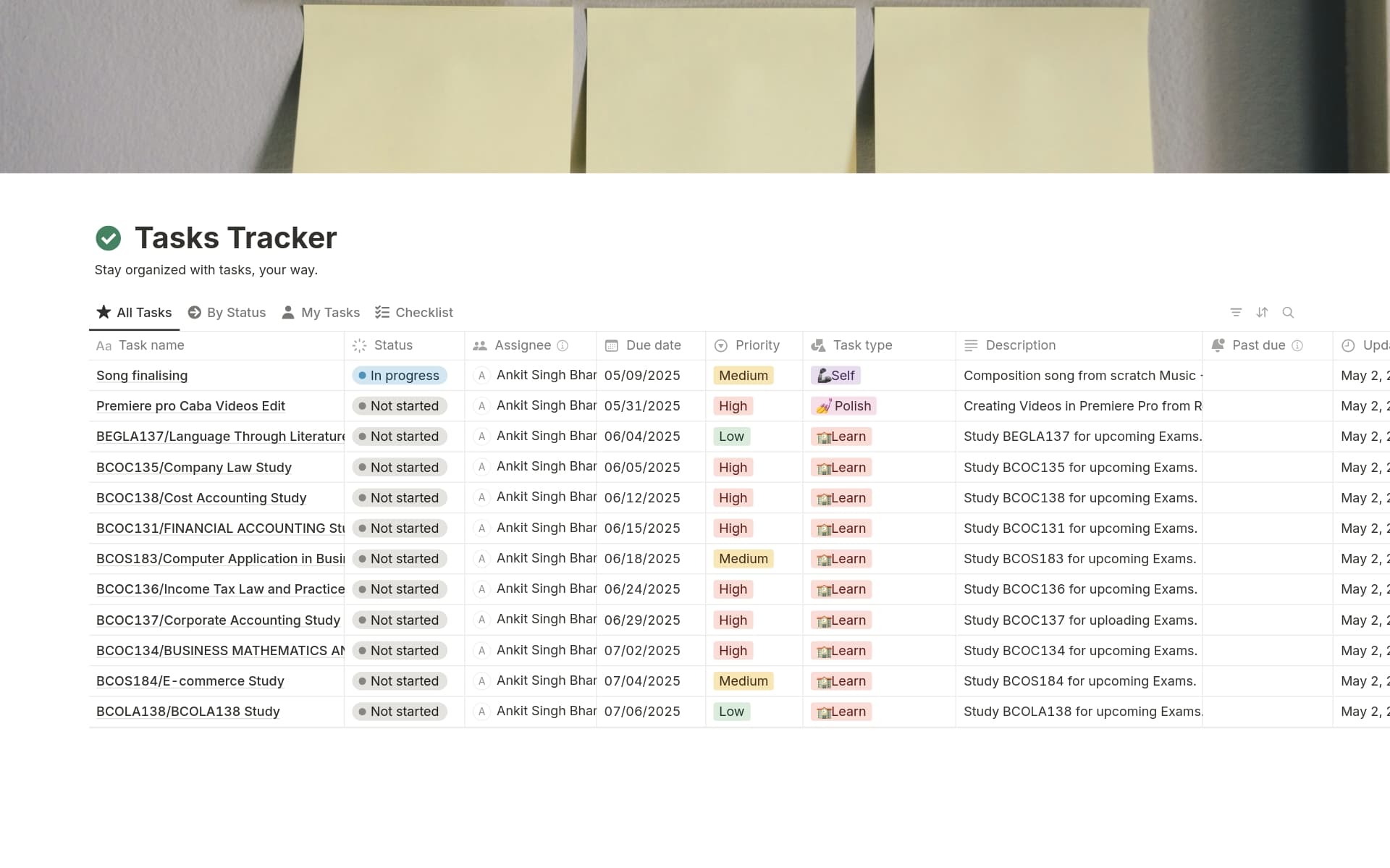

Comprehensive Debt Overview: The template should provide a clear and detailed view of all debts, including amounts, interest rates, and due dates.

Payment Tracker: It's essential to have a feature that tracks payment dates, amounts, and remaining balances to keep everything transparent and on schedule.

Goal Setting: A good template will allow you to set payoff goals and visually track your progress towards these goals, which can be highly motivating.

Reporting Tools: Look for templates that offer reporting capabilities to analyze your debt reduction over time and adjust strategies as necessary.

With these features, a Debt Management Template not only helps in organizing your debts but also empowers you to make informed decisions towards achieving financial freedom.

What Should Debt Management Templates Avoid?

When selecting a debt management template in Notion, it's essential to be aware of certain features that might complicate or hinder your financial tracking and planning. Here are three key components to steer clear of:

Overly Complex Layouts: Templates with too many sections, sub-sections, or intricate designs can make it difficult to quickly update or review your financial status.

Non-Customizable Fields: Avoid templates that do not allow you to modify categories and fields, as personal finance needs can vary greatly from one individual to another.

Lack of Integration Features: Templates that do not support integration with other financial tools or apps limit your ability to have a holistic view of your finances.

Choosing the right template involves looking for simplicity, customization, and integration capabilities to ensure it complements your financial management strategy effectively.