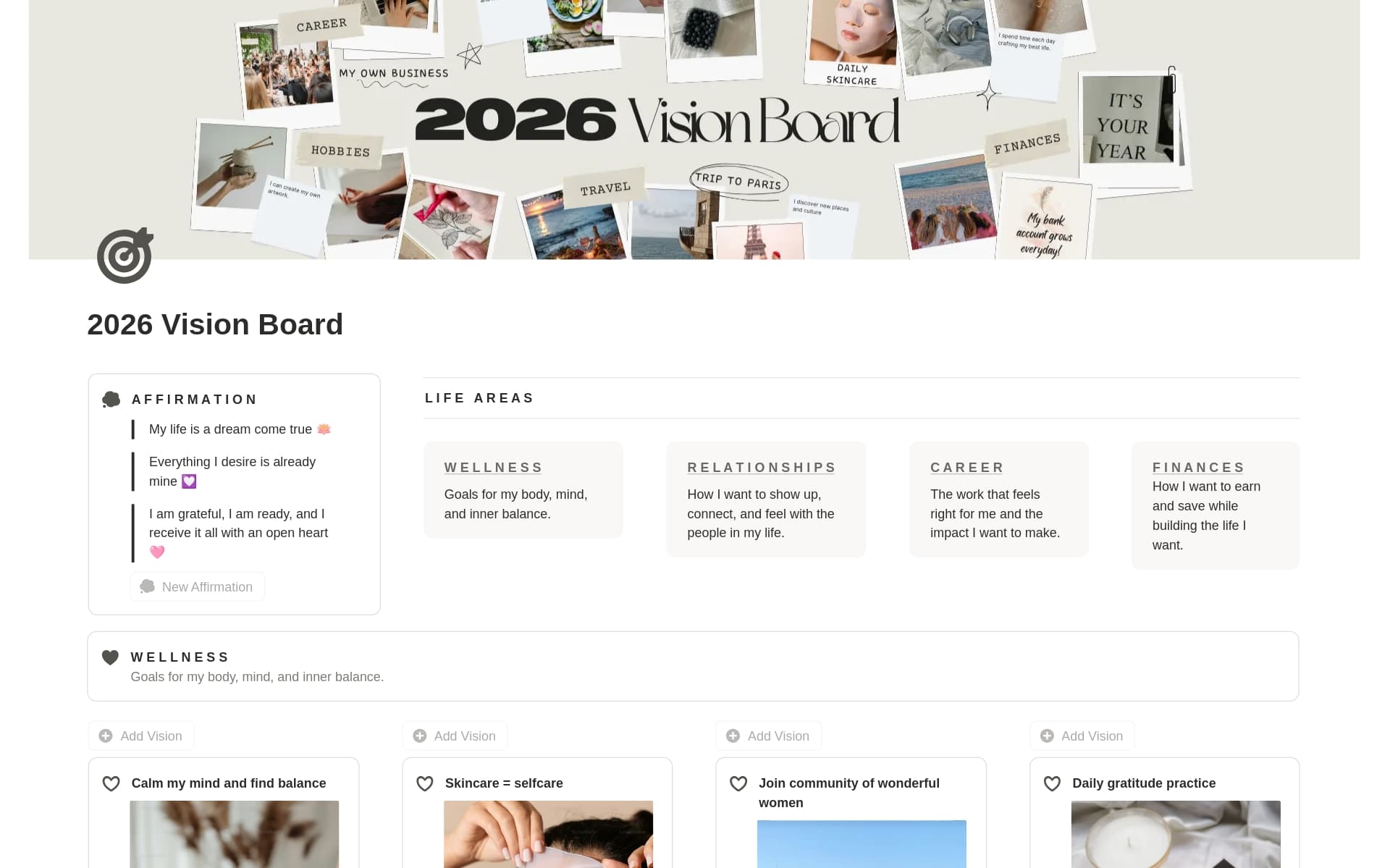

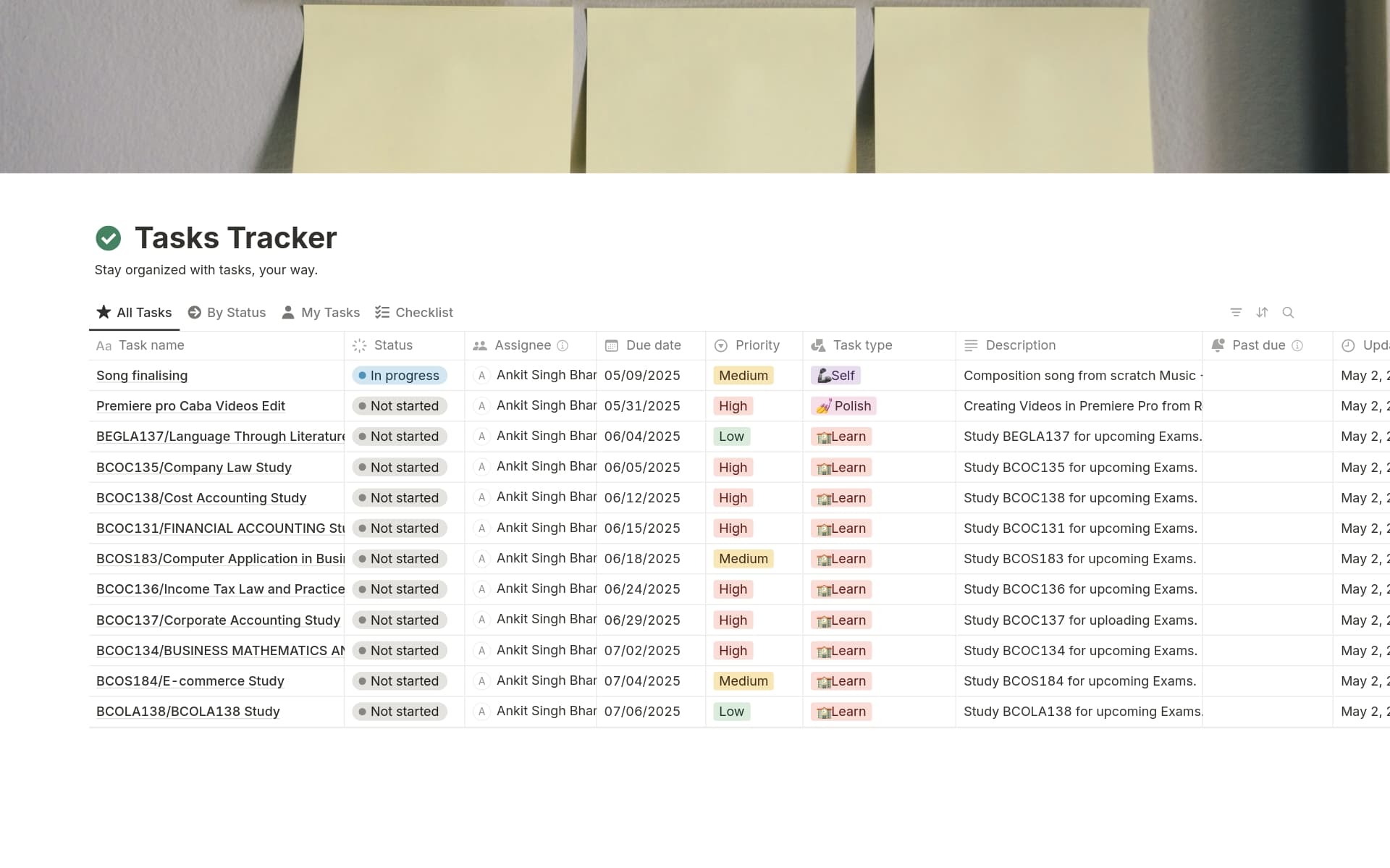

Having a solid Budgeting & Savings plan is crucial for achieving financial stability and reaching your long-term goals. It allows you to manage your money effectively, avoid debt, and save for future expenses. A Budgeting & Savings template in Notion can streamline this process by providing a structured and customizable framework to track your income, expenses, and savings, making it easier to stay on top of your financial health.

Before you dive into creating your own Budgeting & Savings system, consider exploring these Notion templates to simplify the process and ensure you're covering all aspects of your financial life.

What Should Budgeting & Savings Templates Include?

Choosing the right Budgeting & Savings template in Notion can streamline your financial management and help you achieve your savings goals more effectively. Here are key components to look for:

Comprehensive Monthly Budget Overview: This should provide a clear view of your income, expenses, and savings, allowing for easy tracking and adjustments.

Goal Tracking Features: Effective templates should include mechanisms to set, monitor, and update savings goals, ensuring you stay motivated and on track.

Expense Categorization: Look for templates that allow you to categorize expenses. This helps in identifying areas where you can potentially reduce spending.

Visual Reports and Dashboards: Visual tools such as charts and graphs are essential for a quick assessment of your financial health and progress towards your goals.

With these components, a Notion template can transform the way you manage your finances, making the process both intuitive and efficient.

What Should Budgeting & Savings Templates Avoid?

When selecting a Budgeting & Savings template in Notion, it's important to be aware of certain features that might complicate or hinder your financial tracking. Here are three key components to steer clear of:

Overly Complex Categories: Templates with too many specific categories can make it difficult to consistently categorize transactions, leading to confusion and decreased usability.

Non-Customizable Fields: Avoid templates that don't allow you to modify fields. Flexibility is essential as your financial situation and goals may evolve over time.

Lack of Visual Elements: Templates that do not include graphs or charts can make it harder to quickly assess financial health. Visual aids are instrumental in effective budget management.

Choosing the right template involves looking for simplicity, customization, and visual support to ensure it enhances your ability to manage and save money effectively.