Taking control of your finances starts with tracking your net worth. Use Notion templates designed for tracking your net worth to get a clear picture of your financial health.

What Should Net Worth Templates Include?

Choosing the right Net Worth template in Notion can streamline how you track and analyze your financial health. Here are key components to look for in a high-quality template:

Assets and Liabilities Sections: A clear division between assets (what you own) and liabilities (what you owe) helps in assessing your financial standing accurately.

Automatic Calculations: Templates should include formulas that automatically calculate total assets, liabilities, and your net worth, saving you time and reducing errors.

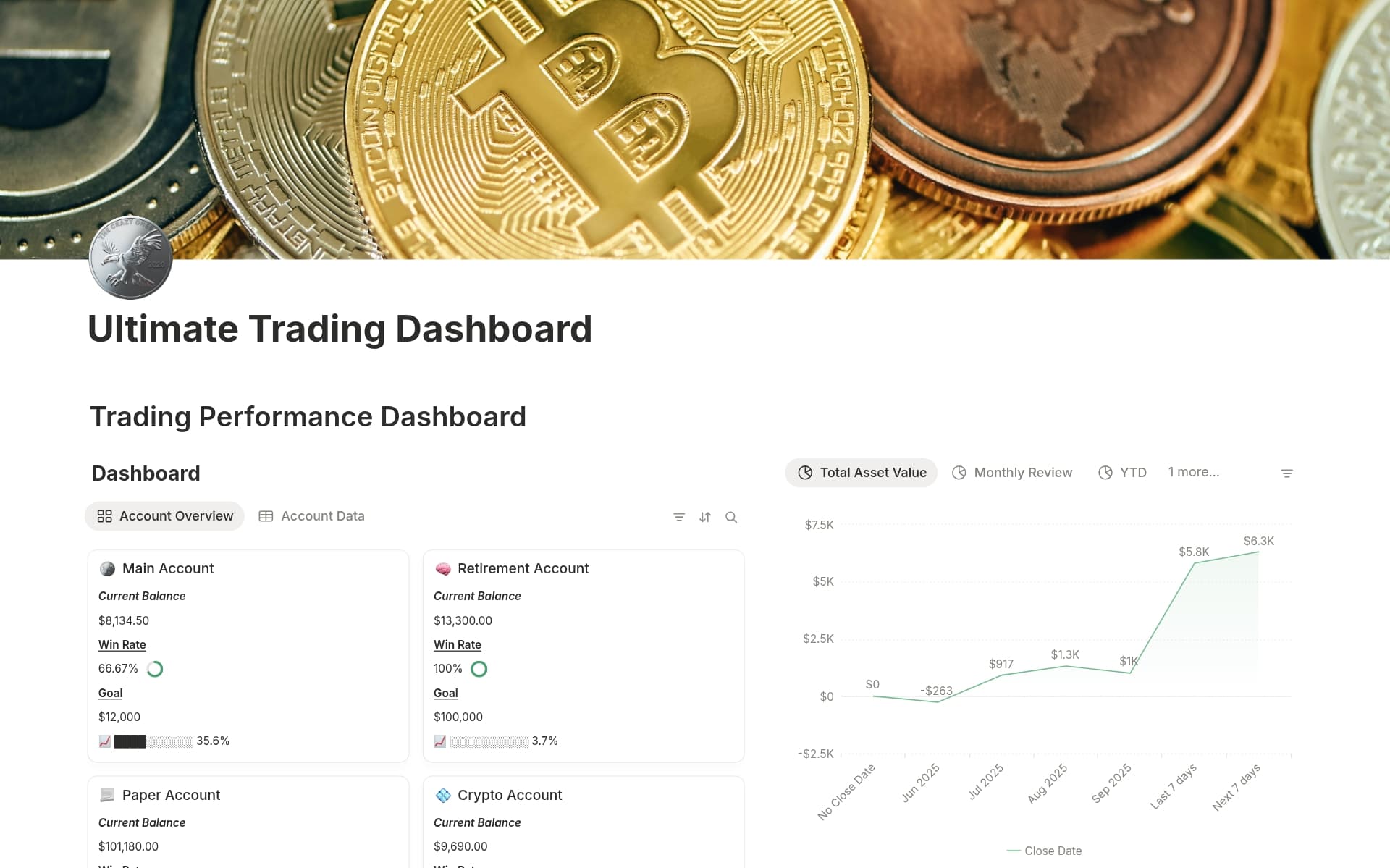

Visual Dashboards: Graphs and charts that visually represent your financial data can make it easier to understand trends and make informed decisions.

Customization Options: Look for templates that allow you to add, remove, or modify categories so the template can grow and change with your financial situation.

With these features, a Net Worth template not only simplifies tracking your finances but also empowers you to make proactive financial decisions.

What Should Net Worth Templates Avoid?

Choosing the right Net Worth template in Notion can significantly streamline your financial tracking. However, it's important to be aware of certain features that might complicate or mislead your financial overview.

Overly Complex Categories: Templates with too many detailed categories can make it difficult to maintain and could lead to confusion rather than clarity in your financial snapshot.

Non-Customizable Fields: Avoid templates that don't allow you to add or modify fields. Flexibility is key as your financial situation and goals may evolve over time.

Excessive Automation: While some automation can be helpful, too much can obscure how the calculations are made, making it hard to trust the accuracy of your net worth calculation.

Ultimately, the best Notion template for tracking net worth is one that offers simplicity, customization, and just the right amount of automation to keep you informed and confident about your financial health.