Understanding an individual's or a family's net worth is a fundamental step in financial planning. It provides a clear snapshot of where they currently stand financially, by outlining the value of their assets minus liabilities. Such insight is invaluable for financial advisors as it aids in tailoring advice, setting realistic goals, and monitoring clients' financial progress over time. A Net Worth Notion template simplifies this process by offering a structured and efficient way to organize and update financial information, making it easier to visualize changes in net worth and adjust strategies accordingly.

Before you start crafting your own Net Worth template, take a moment to explore these curated Net Worth Notion templates to streamline the task.

What Should Net Worth Templates Include?

Choosing the right Net Worth Template is crucial for effectively managing and tracking your financial health. Here are key components to look for in a high-quality template:

Assets and Liabilities Sections: A clear division between assets and liabilities helps in understanding your financial position quickly and accurately.

Automatic Calculations: Templates should include formulas that automatically calculate total assets, liabilities, and your net worth, saving time and reducing errors.

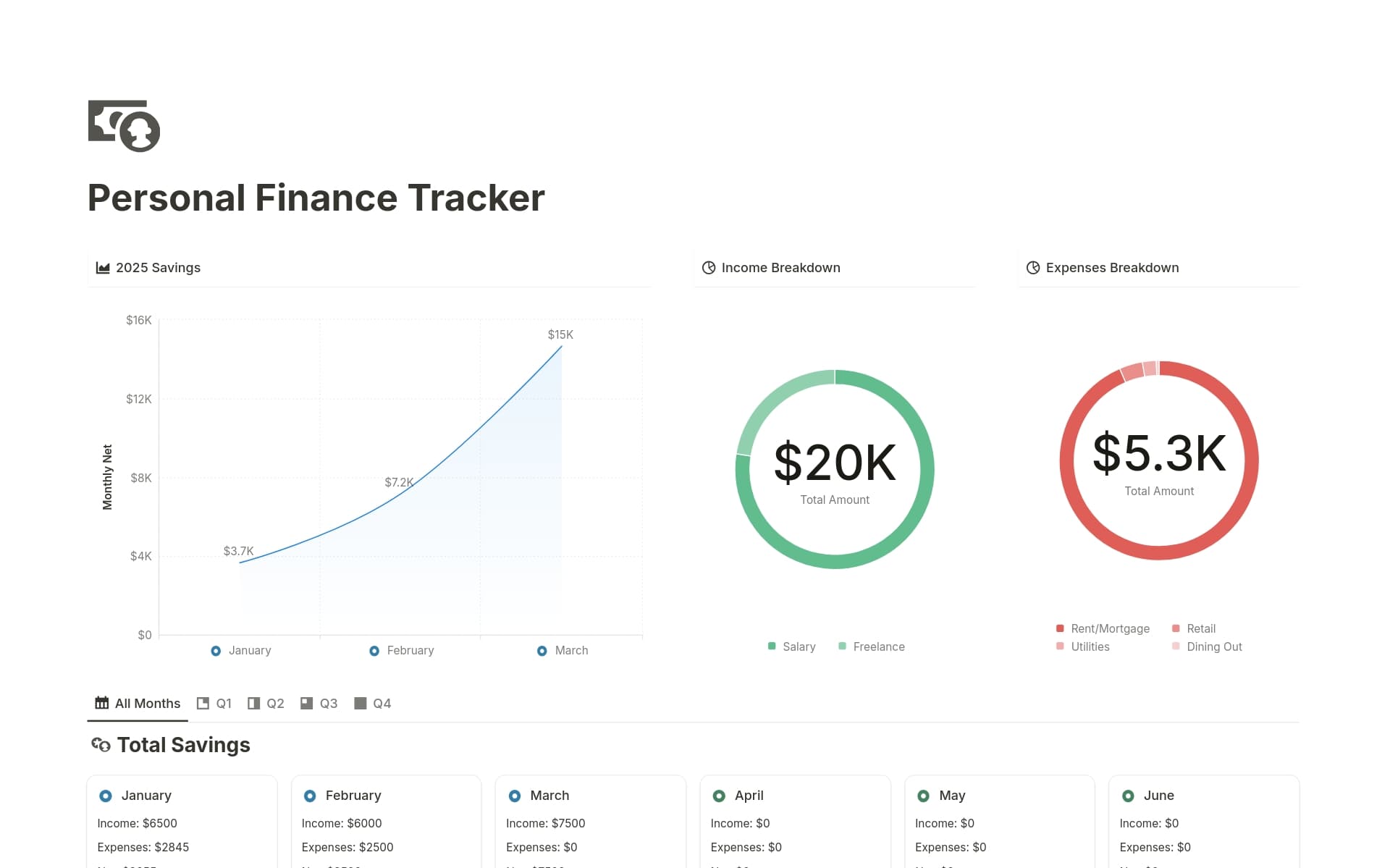

Visual Representations: Graphs and charts that visually depict your assets, liabilities, and net worth can make it easier to interpret data at a glance.

Customization Options: The ability to customize categories and values ensures that the template can adapt to your specific financial situation.

With these components, a Net Worth Template not only simplifies tracking your finances but also provides deep insights into your financial trajectory.

What Should Net Worth Templates Avoid?

Choosing the right Net Worth template is crucial for accurate financial tracking and analysis. However, certain features can complicate or obscure the clarity of your financial overview. Here are three key components to steer clear of:

Overly Complex Formulas: Templates that include complicated calculations can be error-prone and difficult to adjust. Opt for simplicity to ensure reliability and ease of use.

Non-Customizable Categories: Avoid templates that don't allow you to modify or add categories. Each financial situation is unique, and flexibility is essential for accurate representation of your assets and liabilities.

Excessive Visuals: While charts and graphs can be helpful, too many visuals may distract from the main data. Choose templates that balance clear, concise data presentation with visual aids.

Selecting a template that avoids these pitfalls will provide a clearer, more useful tool for monitoring and planning your financial health.