For Payroll Managers, investing is a method to ensure the financial health and growth of funds under their management. By carefully allocating resources into various investment vehicles, they can potentially yield better returns, safeguard against inflation, and manage cash flow more efficiently for their organization or clients. An Investing Notion template simplifies this process by offering a structured way to track investments, monitor performance, and make informed decisions based on data trends and financial insights.

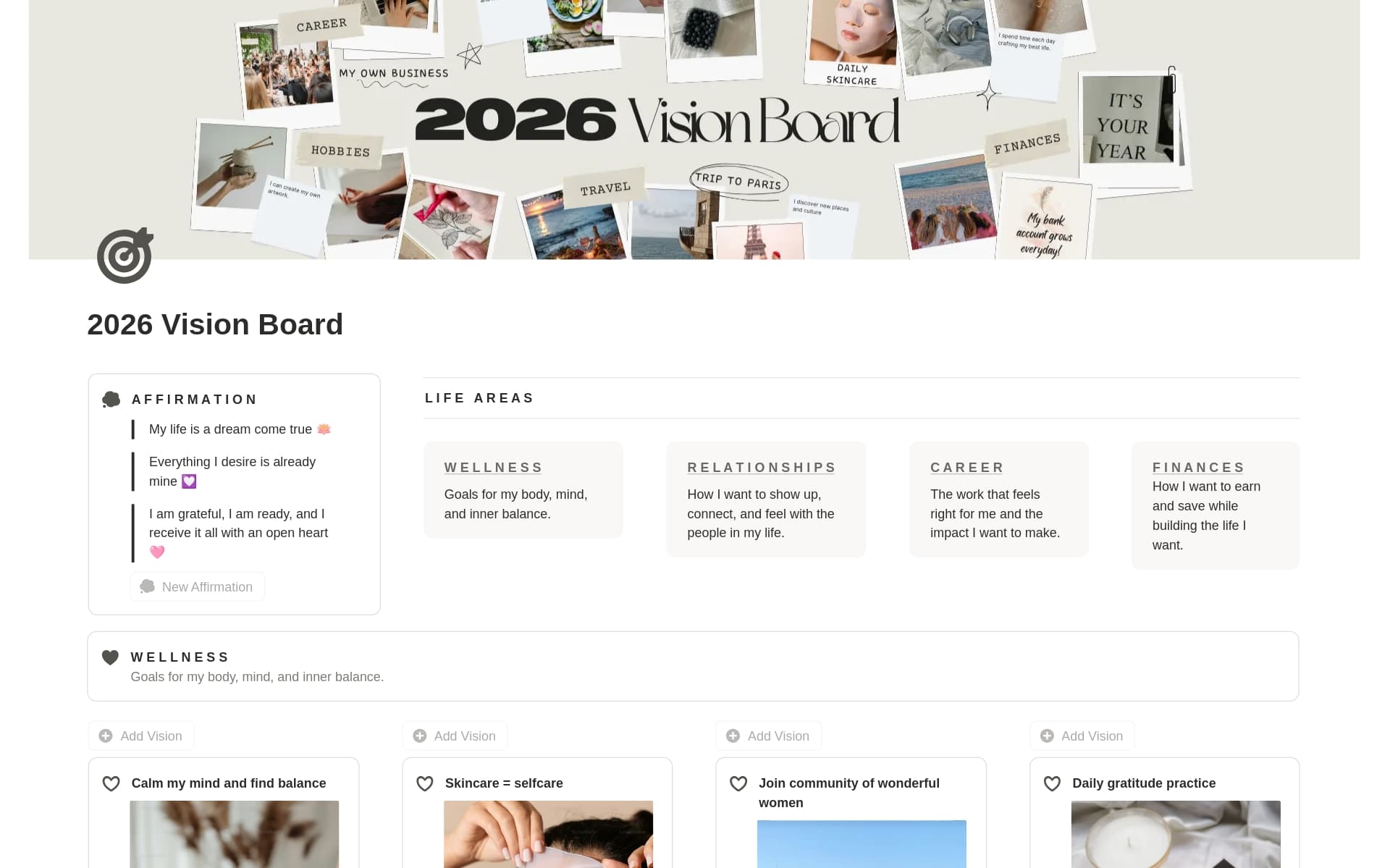

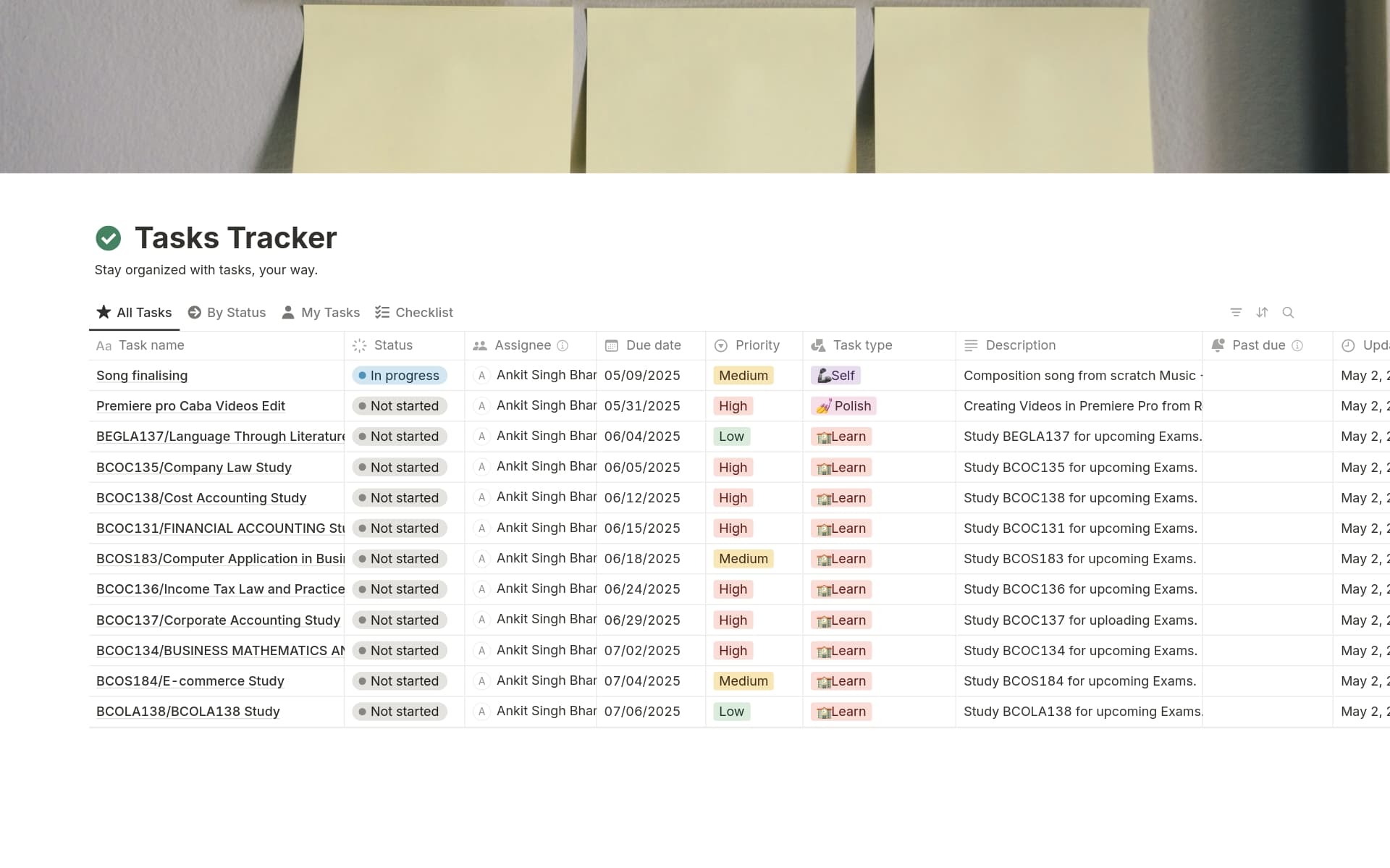

Before embarking on creating your personalized Investing template, consider exploring these professionally designed Notion templates to streamline your investment management efforts.

What Should Investing Templates Include?

Choosing the right investing template can streamline the decision-making process for payroll managers by organizing essential financial data effectively. Here are key components to look for:

Comprehensive Financial Overview: The template should provide a clear and detailed view of all investment assets, including stocks, bonds, and other securities.

Risk Assessment Features: It's crucial to have tools that help evaluate the risk associated with different investments, aiding in making informed decisions.

Performance Tracking: A good template will include features to track the performance of investments over time, comparing it against market benchmarks.

Forecasting Tools: Look for templates that offer predictive tools to forecast future trends based on historical data, which can be invaluable for strategic planning.

Selecting a template with these components will ensure that you have a robust tool to manage and analyze your investments efficiently.

What Should Investing Templates Avoid?

Choosing the right investing template is crucial for payroll managers who need to manage investments efficiently. However, certain features can complicate or hinder the process rather than help.

Overly Complex Formulas: Avoid templates that use complex and hard-to-understand formulas. These can make it difficult to adapt the template to your specific needs and increase the risk of errors.

Non-customizable Elements: Steer clear of templates that don't allow you to modify fields and formats. Flexibility in customization is key to tailoring the template to align with your company's specific investment strategies.

Excessive Automation: While automation can be beneficial, too much of it can remove your control over the investment decisions. Templates should aid your decision-making, not replace it.

Remember, the best template is one that simplifies your investment management without stripping away your control or understanding of the process.