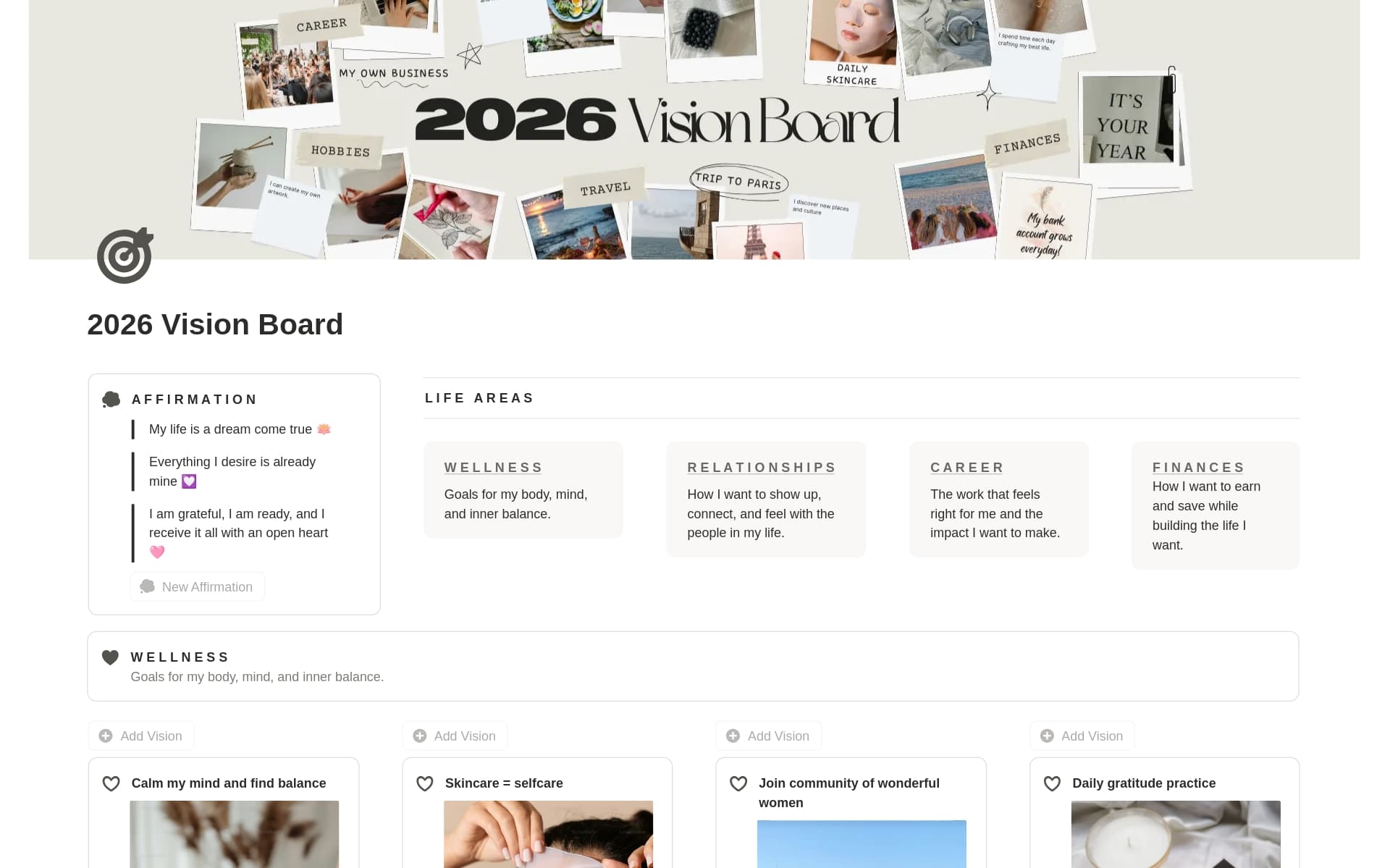

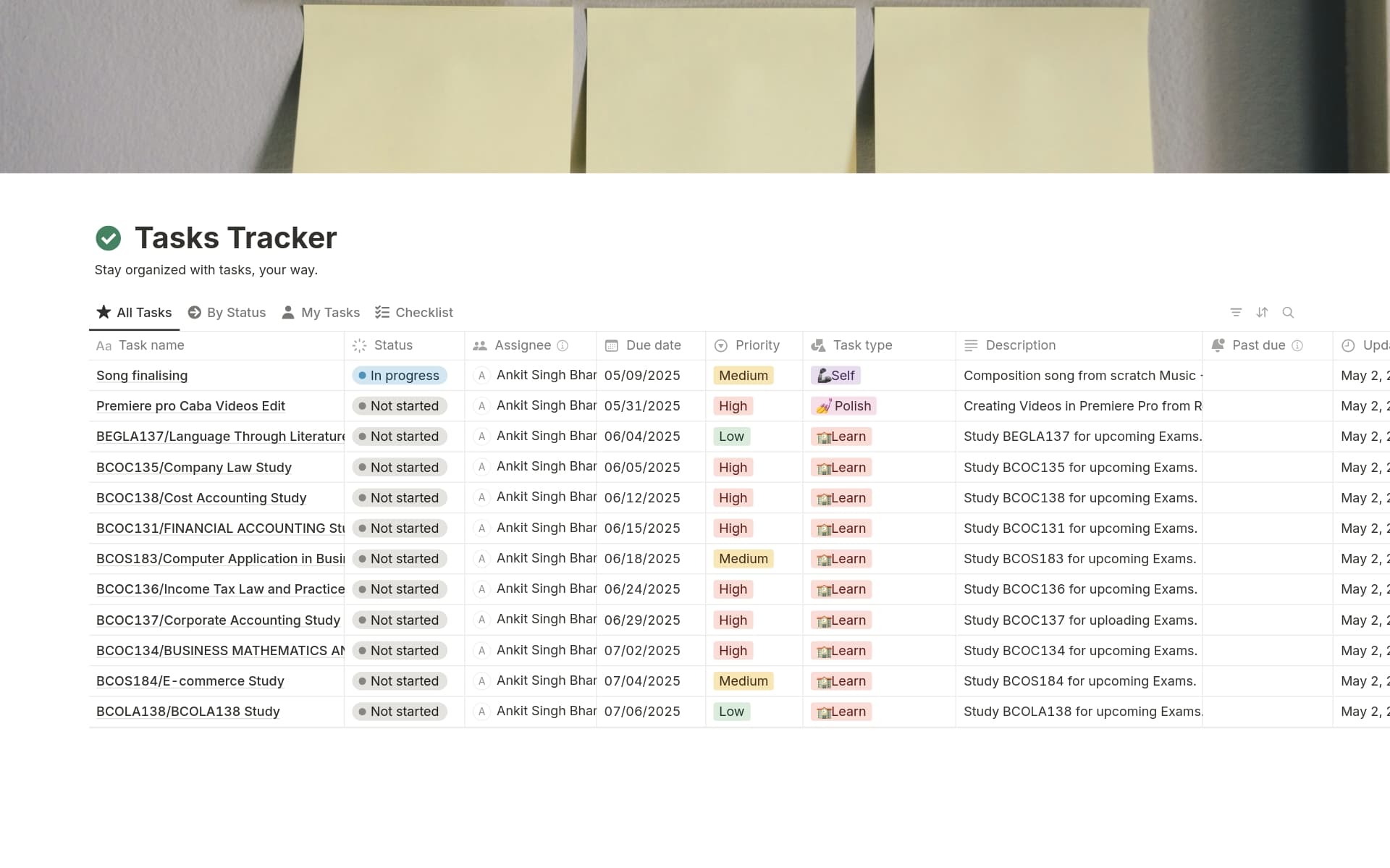

Notion's all-in-one workspace makes it easy to take control of your finances. Design budgets, track expenses, and set savings goals all in one organized place.

What Should Personal Finance Templates Include?

Choosing the right Personal Finance template in Notion can streamline your budgeting and financial tracking. Here are key components to look for in a high-quality template:

Budget Tracker: This component should allow you to easily input and categorize expenses and income, helping you monitor your spending habits over time.

Investment Portfolio: A good template will include a section to track your investments, providing insights into performance and growth to help you make informed decisions.

Debt Management: Look for a template that offers tools for recording and strategizing the payoff of debts, such as loans and credit cards.

Savings Goals: A section dedicated to setting and tracking savings goals can motivate you to reach financial milestones and prepare for future expenses.

Selecting a template with these features will not only help you manage your finances more effectively but also provide a clear picture of your financial health.

What Should Personal Finance Templates Avoid?

Choosing the right personal finance template in Notion can streamline your budgeting and financial tracking. However, it's important to steer clear of certain features that can complicate or hinder your financial management.

Overly Complex Categories: Templates with too many specific categories can make it difficult to consistently categorize transactions, leading to confusion and mismanagement of funds.

Non-Customizable Fields: Avoid templates that don't allow you to modify fields. Personal finance needs vary, and the ability to tailor categories and budgets is essential for effective tracking.

Heavy Visual Elements: While visually appealing, templates that focus too much on graphics and colors often detract from functionality, making it harder to quickly assess financial standings.

Remember, the best template is one that fits your personal financial goals and habits without adding unnecessary complexity or restricting flexibility.