Investing is a way of managing your finances and growing your wealth over time. It's important in your life because it helps you achieve financial goals, such as buying a house, funding your retirement, or even starting a business. An Investing template can simplify the process by providing a structured framework to track your investments, monitor their performance, and make informed decisions.

Before deciding to create your Investing template, it's worth checking out some of the free investing templates available below.

What Should Investing Templates Include?

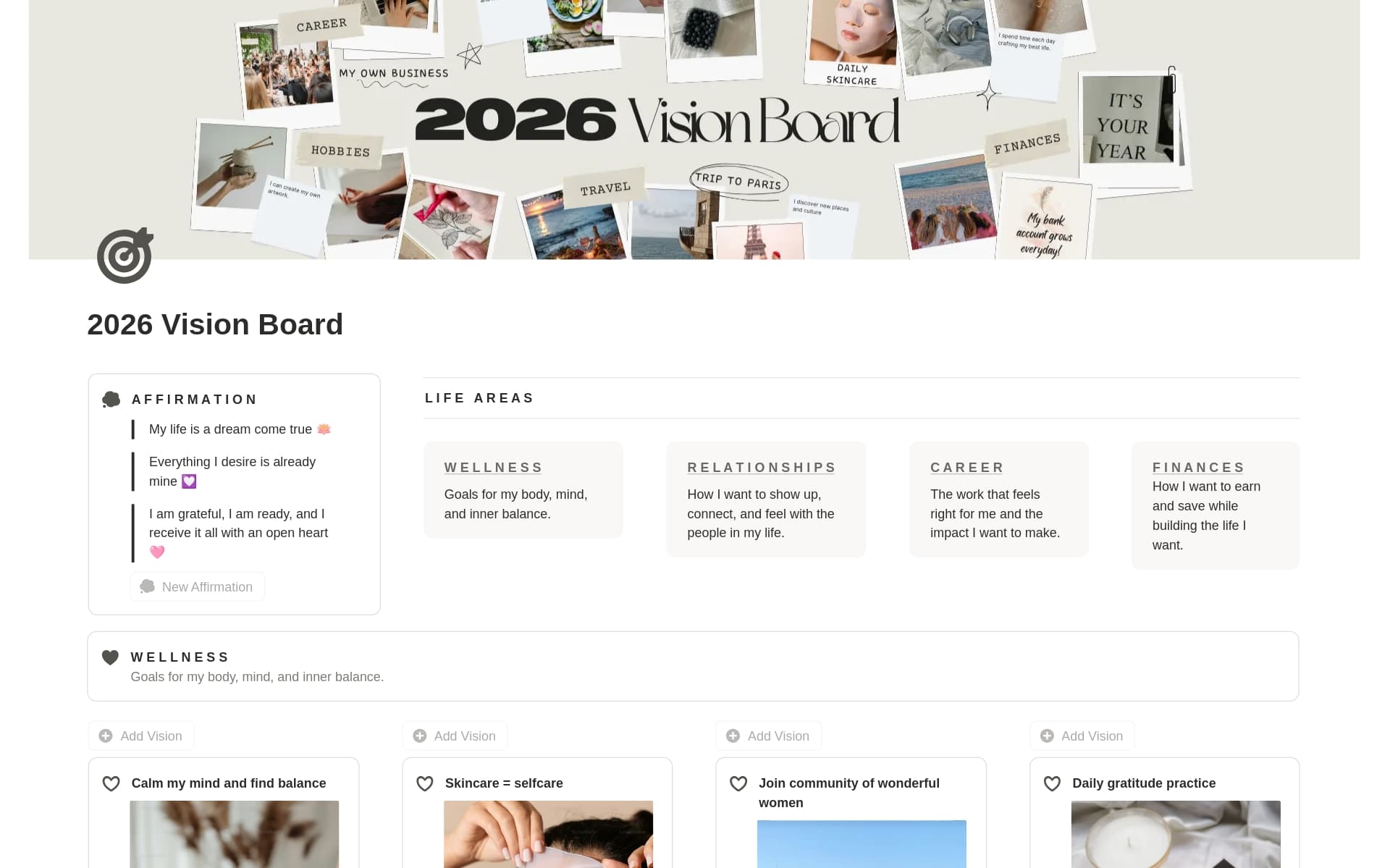

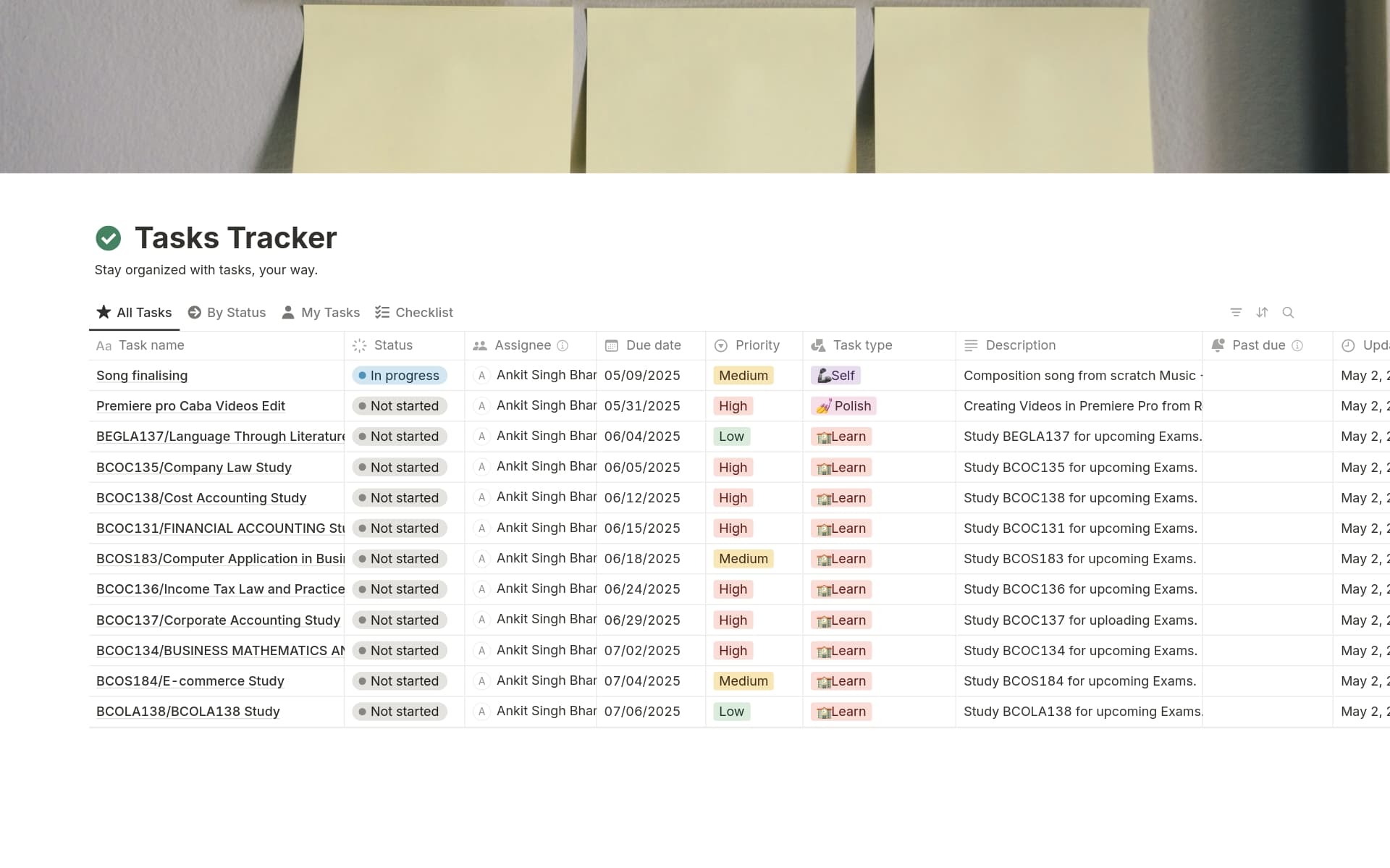

Choosing the right investing template in Notion can streamline your financial tracking and analysis. Here are key components to look for when selecting a template:

Portfolio Overview: A comprehensive dashboard that provides a quick snapshot of your investments, including current values, performance metrics, and growth charts.

Asset Allocation: This should detail your investments across different categories and asset classes, helping you maintain a balanced and diversified portfolio.

Transaction Tracker: An effective template should include a section to record all your buy and sell transactions, dividends, and other investment-related activities.

Performance Analysis: Look for templates that offer tools for analyzing the performance of your investments over time, comparing them against benchmarks or goals.

Selecting a template with these components will ensure you have a powerful tool at your fingertips to manage and grow your investments effectively.

What Should Investing Templates Avoid?

When selecting a free investing template in Notion, it's important to be aware of certain features that might complicate or hinder your investment tracking. Here are three key components to steer clear of:

Overly Complex Formulas: Templates that rely heavily on complex formulas can be prone to errors and difficult to customize or update. Simplicity often yields the best clarity.

Non-customizable Categories: Avoid templates that don't allow you to edit or add new categories. Investment needs vary, and flexibility is essential for tailoring the template to your specific requirements.

Limited Integration Capabilities: Ensure the template can integrate with other tools and platforms you use. Lack of integration can lead to manual data entry, increasing the risk of mistakes.

Choosing the right template involves looking for simplicity, flexibility, and integration capabilities to ensure it enhances your investment management rather than complicating it.