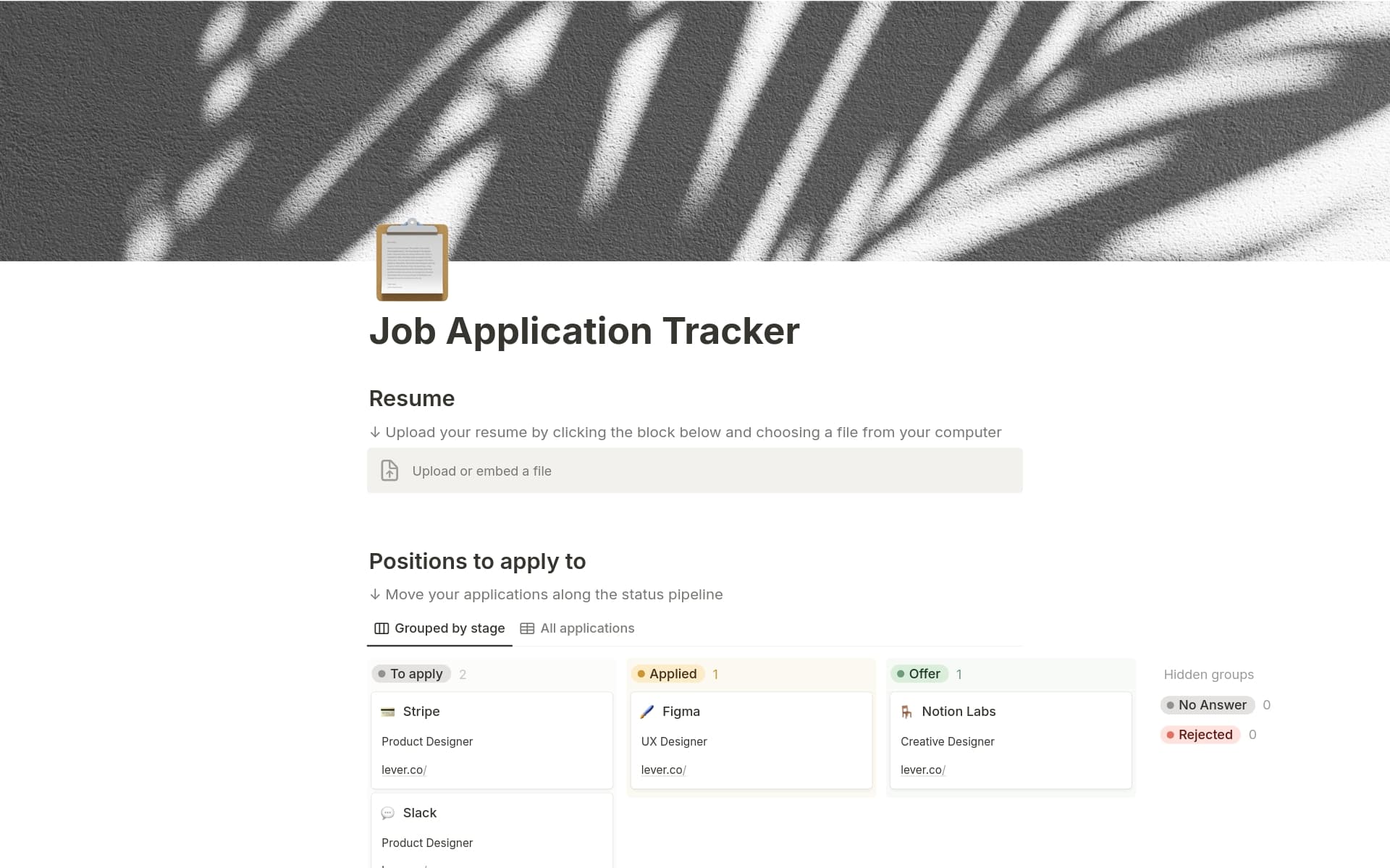

Investing is an integral component of financial management, offering a pathway to achieving growth and stability in financial assets over time. For finance managers, it enables the effective allocation of resources to meet both short-term and long-term objectives. An Investing template in Notion could streamline this process by offering organized ways to track investments, analyze trends, and strategize accordingly, making it easier to manage and monitor portfolios efficiently.

Before you dive into creating your own Investing template, explore the diverse Investing templates listed here to simplify the process and enhance your investment management strategy.

What Should Investing Templates Include?

Choosing the right investing template can streamline the decision-making process for finance managers. It's crucial to select a template that not only organizes data efficiently but also enhances analytical capabilities.

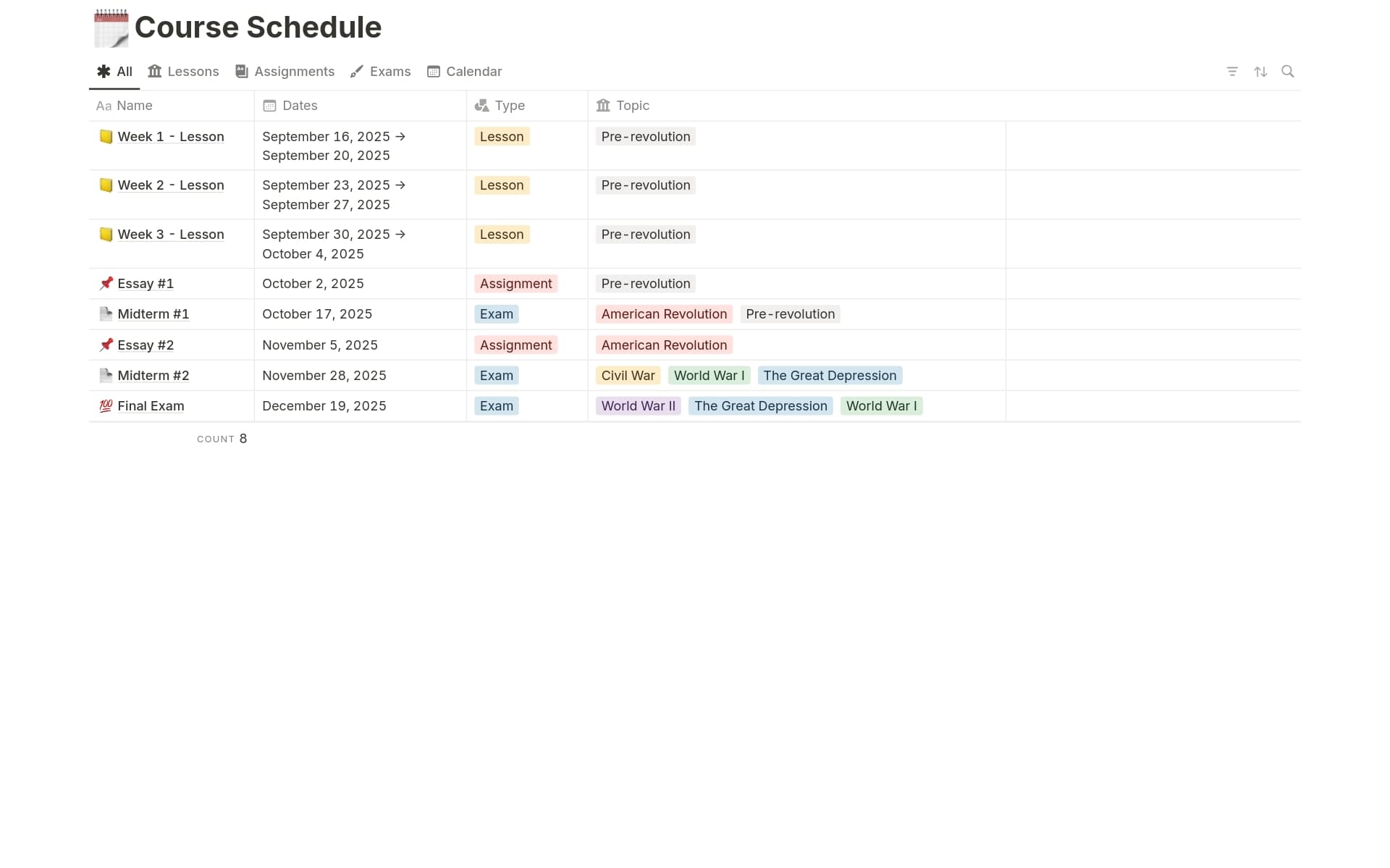

Comprehensive Financial Metrics: The template should include key financial indicators such as ROI, IRR, and NPV to help assess investment opportunities quickly and accurately.

Risk Assessment Tools: Features that help evaluate the risk associated with different investments can guide managers in making informed decisions.

Portfolio Overview: A good template will offer a clear and concise dashboard that provides a snapshot of the entire portfolio’s performance at a glance.

Historical Data Analysis: Access to historical market data and performance trends can aid in predicting future investment outcomes and market movements.

Effective templates empower finance managers to not only track their investments but also to foresee potential market changes and adjust strategies accordingly.

What Should Investing Templates Avoid?

Choosing the right investing template is crucial for finance managers. It's important to know what features can hinder rather than help. Here are a few key components to steer clear of:

Overly Complex Interfaces: Templates that feature complicated designs can obscure important data and slow down decision-making processes.

Non-Customizable Elements: Avoid templates that don't allow you to adjust variables and parameters according to your specific needs and preferences.

Limited Data Integration: Templates that do not support integration with other financial tools or databases can limit your ability to analyze comprehensive datasets.

Remember, the best template is one that simplifies analysis, adapts to your needs, and integrates seamlessly with other tools.