Investing is a fundamental aspect of financial planning, offering a pathway to achieve financial goals through the strategic allocation of assets. For financial advisors, understanding and managing investments are key to advising clients on how to grow their wealth over time. An Investing template can streamline the tracking and analysis of various investment vehicles, enabling advisors to make informed decisions and recommendations with ease.

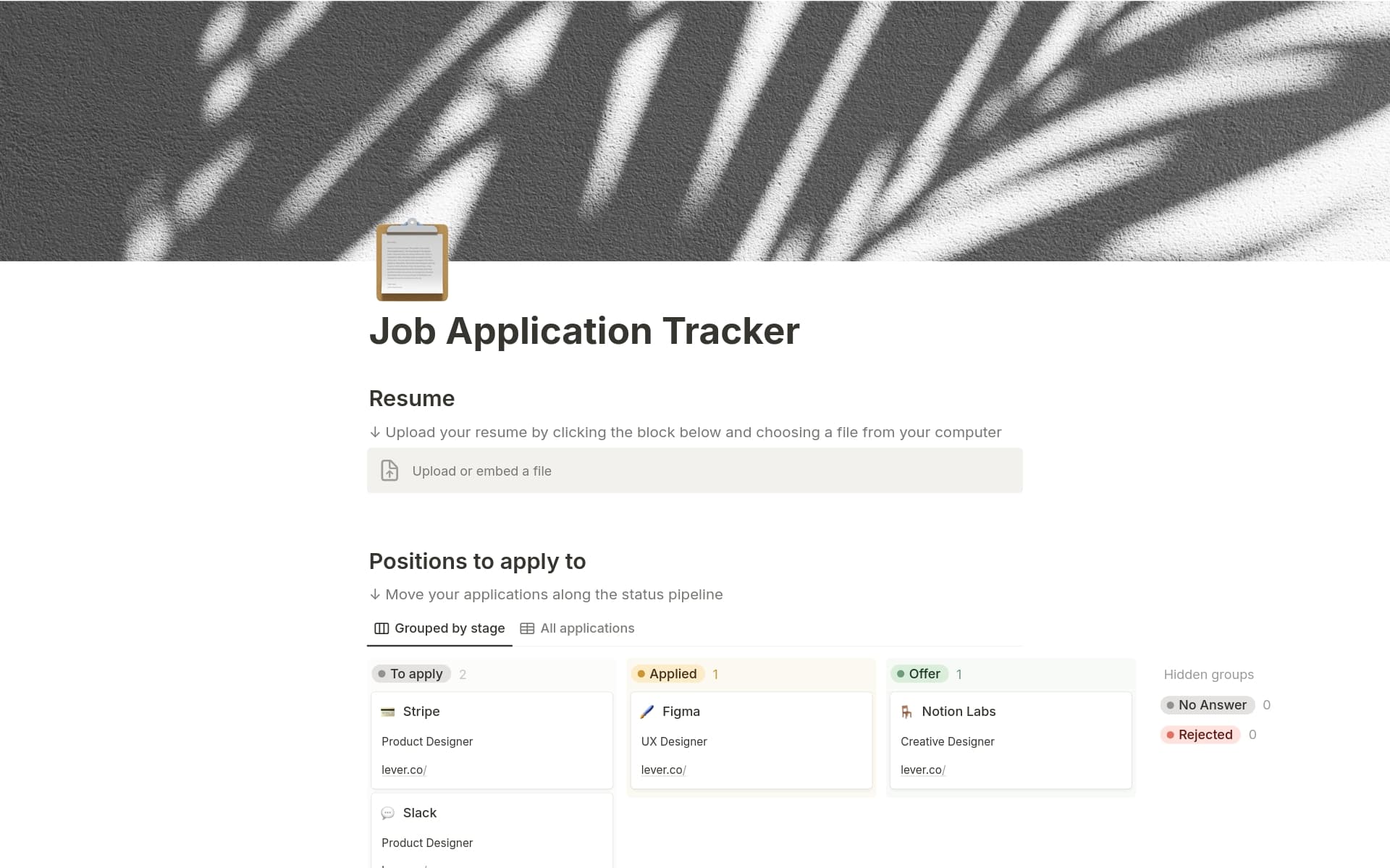

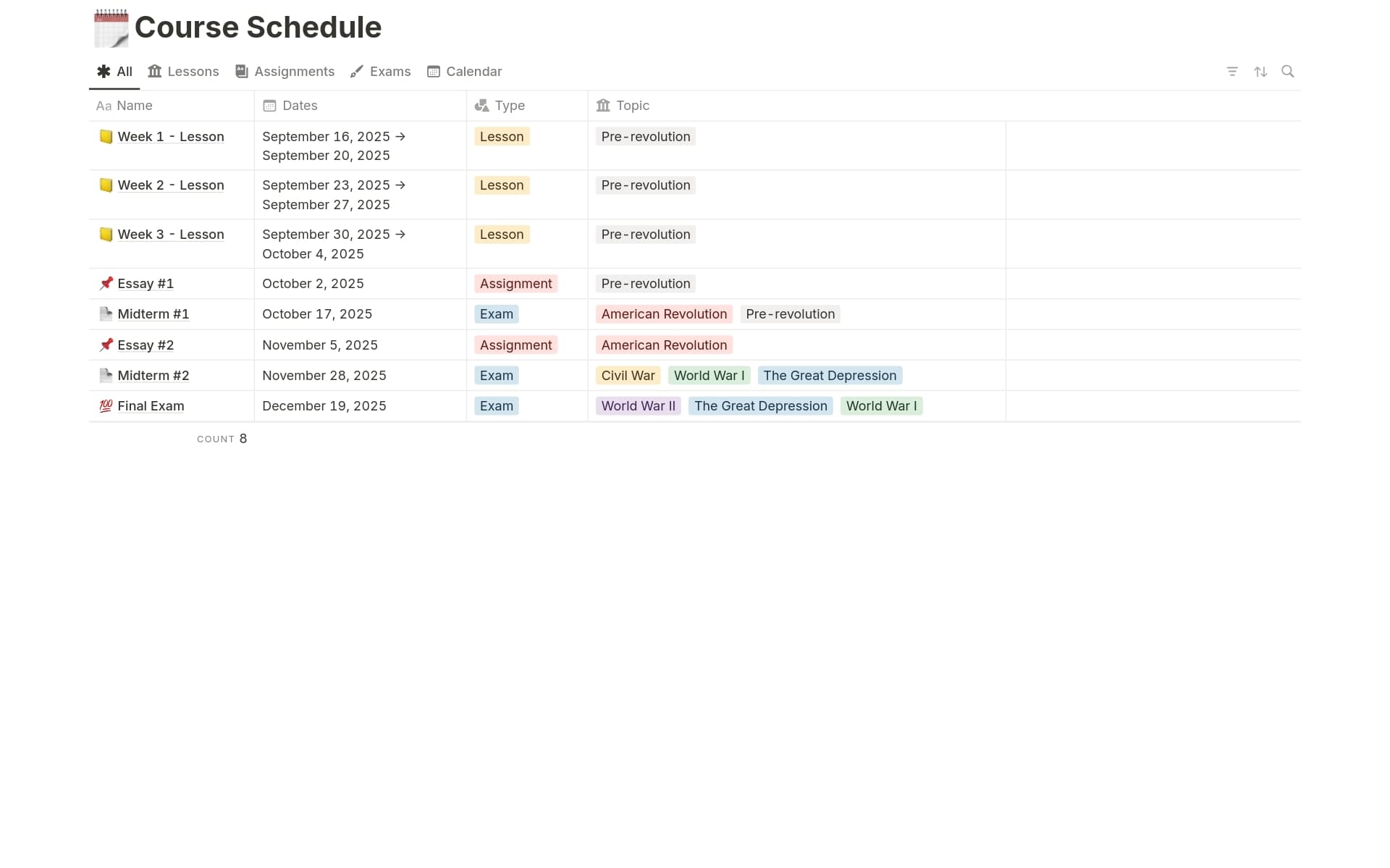

Before you dive into crafting your own Investing template, consider exploring these curated options to simplify the process.

What Should Investing Templates Include?

Choosing the right investing template can streamline the monitoring and analysis of financial portfolios. Here are key components to look for in an effective Investing Notion template:

Asset Allocation Overview: This component should provide a clear visualization of different asset classes within the portfolio, helping you understand the diversification at a glance.

Investment Tracking: Features that allow for tracking the performance of individual investments over time are crucial. This should include historical data analysis capabilities to gauge growth and identify trends.

Risk Assessment Tools: A good template should include tools or sections that help assess the risk associated with different investments, aiding in making informed decisions.

Financial Goals Mapping: Ensure the template has a section to align your investments with financial goals. This helps in evaluating how well your current assets and strategies align with your long-term objectives.

With these components, a Notion investing template can become an indispensable tool for managing and growing your financial portfolio effectively.

What Should Investing Templates Avoid?

Choosing the right investing template is crucial for financial advisors. It's not just about what you include, but also what you should avoid to ensure clarity and efficiency.

Overly Complex Models: Avoid templates that include excessively complicated financial models which can confuse and deter users, making the template less practical for everyday use.

Non-customizable Elements: Steer clear of templates that don't allow you to adjust variables and parameters. Flexibility is key in adapting to different clients' needs and market conditions.

Irrelevant Metrics: Ensure the template does not focus on irrelevant metrics that do not align with your client's goals or the scope of their investments, as this can lead to misguided strategies.

Remember, the best template is one that balances simplicity with functionality, helping you make informed decisions without unnecessary complications.